This post was contributed by the team at www.digitalexits.com – is you are looking to sell your ecommerce business they are offering a free valuation for all income diary readers.

You have grown your ecommerce business over time with a lot of time and effort and now you are looking to sell. You want to get the highest price possible and you are looking at the options as to what you can do to sell the business. We will cover all of the questions you have about using an ecommerce business broker. However let’s first start with the number one question that every business owner asks us.

What Is Your Ecommerce Business Worth?

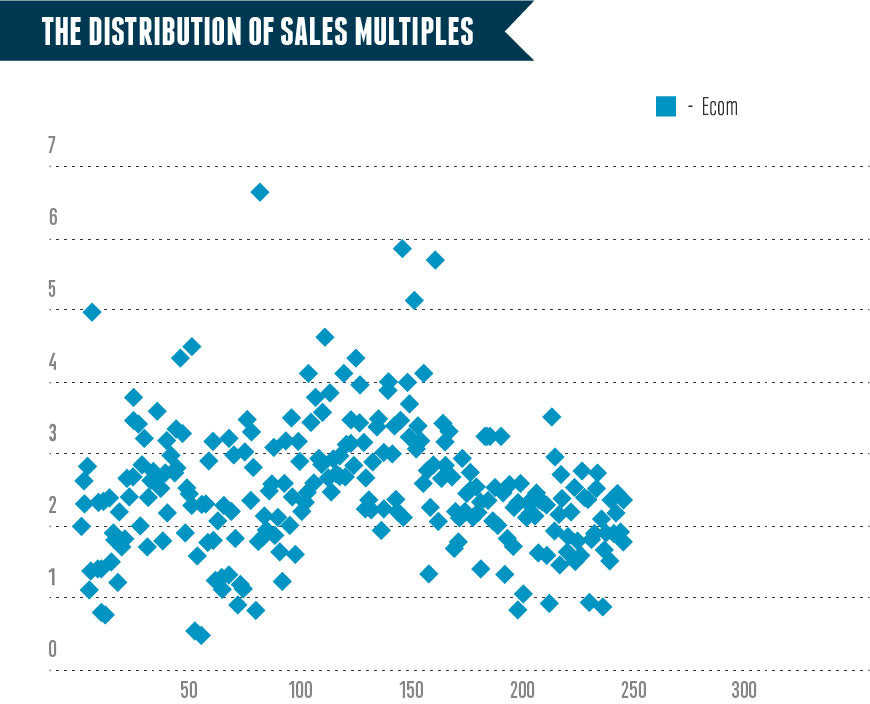

Always the first question that we get asked at Digital Exits by clients is what is my business worth? The answer to any valuation question is what the market will pay. The below graph shows the distribution of the multiples that ecommerce businesses sold in a report that we analyzed.

The multiples range from 0.5X to 6.6X in this distribution graph. This means if you have a business that makes $300,000 in net profit per year, the valuation range is from $150,000 to $1.980,000. Visually what you can see from the graph is that most businesses sell between the 1.5X – 3.5X range. This backs up the commonly held belief that a small to medium business sells in the 2-3times earnings valuation range.

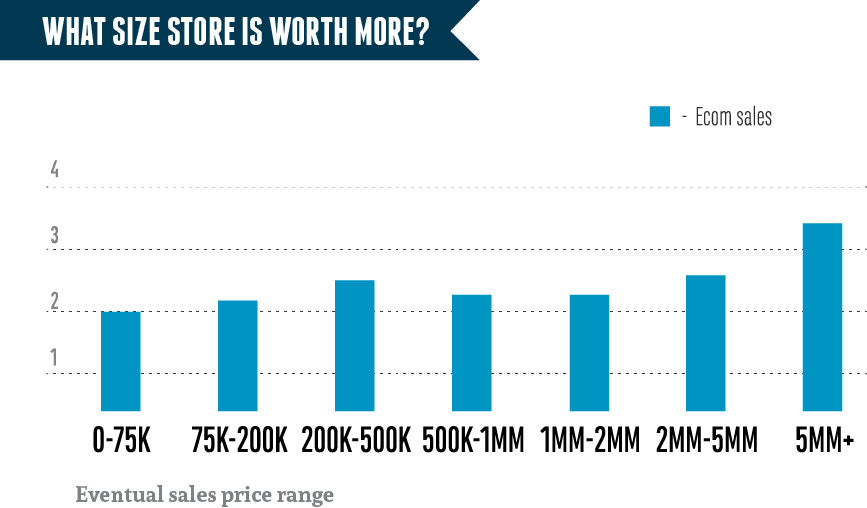

Are bigger ecommerce businesses worth more?

Yes. The large the business the higher the value that the business will sell for. As you can see from the graph the larger the business the higher the selling multiple. So a business that sold for 6 million on average sold for a multiple of 3.5 times earnings which would mean that it was making $1.7 million in profit per year.

What Is An Ecommerce Business Broker and What Do They Do?

An ecommerce business broker sells established ecommerce businesses. The role of the business is as follows.

- Value ecommerce businesses

- Develop a selling document

- Market the business to qualified buyers

- Field offers

- Assist with due diligence

- Assist with deal closing

- Manage the admin

How Does The Process Work?

The selling process if fairly straight forward but can be more complex and take more time depending on the size of the business. In general, most sales will be structured like this:

- Learn what your business is worth with a valuation

- Digital Exits prepares the selling document

- Market your business to qualified buyers

- Negotiate an offer

- Transfer the assets & money

- Help train the new buyer

Why Would You Hire A Broker?

There are two main benefits of using a broker:

- Qualified buyer database

- Knowledge and expertise in the deal making process

What you don’t have as a business owner is a network of buyers that are looking to buy businesses like your or the knowledge or time to go through the process

How Long Does The Process Take?

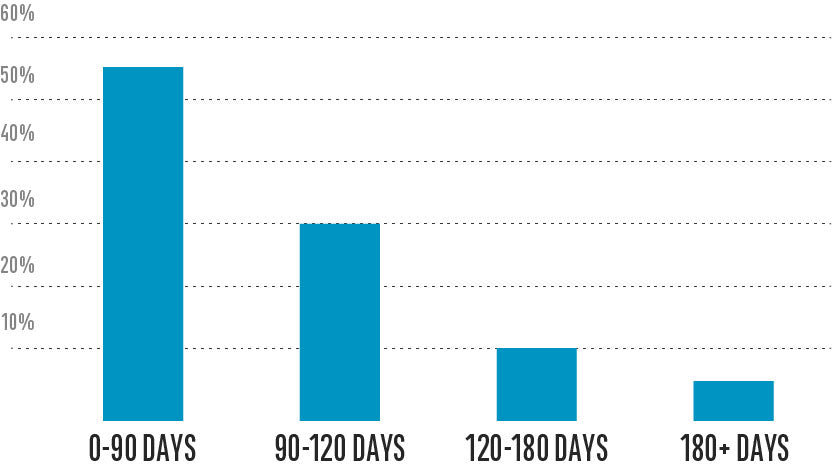

The graph below represents the summary of all the deals that we have completed and the time it took to complete them on average. As you can see, over 50% of deals close within 90 days and over 70% close within four months. The reason this is so fast is that there is a lot of demand to acquire established online businesses.

How Much Do They Cost?

An ecommerce business broker will charge around 10-12% of the total selling price.

This fee is due due upon the success of the deal so if you don’t get paid they don’t get paid.

How Much Should My Business Be Making to Engage A Broker?

If you business is making up to $3,000,000 in net profit per year then a broker will be able to assist you in the sale. If you business makes more profit than that we suggest you use a small market mergers and acquisitions firm. Please contact us for recommendations on the best company to work with.

Why do buyers say “No”?

Here are some of the main reasons a buyer will say no to a deal:

- They just don’t like the business

- The niche isn’t a fit

- They can’t verify the stats and data

- The find something in the due diligence that makes them re-consider the offer

- The price is too high

- The funding of the buyer falls through